The past few years have been lucrative for the wealth management industry thanks to favorable market performance. But, with today’s economic challenges and a changing client demographic as younger generations inherit, firms and advisors must plan how they communicate with current clients and attract new ones to grow AUM.

A recent article by McKinsey highlights what has changed in wealth management over the last few years and what the industry must do. While the report outlines multiple areas to reset, this article focuses on one area; how financial content provides opportunities for advisors and firms to outperform their peers amid challenging circumstances. According to McKinsey’s research, wealth management firms, and advisors must:

“Proactively deepen client relationships.

Our research suggests that proactive and frequent communication with clients leads to a higher degree of satisfaction. As communication frequency increases from once or twice per year to monthly, customer satisfaction scores increase by 52 percent. This is especially relevant in the current macroeconomic climate, which has created anxiety for clients, many of whom have built financial plans based on obsolete macroeconomic assumptions. Wealth managers who are proactive now and help their clients navigate the current environment can win their loyalty. Centralized digital communications enabled by analytics can be invaluable for advisor-led and direct models by providing tailored messages and enabling targeted outreach (for example, identifying and reaching out to clients who are at the highest risk of moving assets away, have not been in touch with their advisor or relationship manager recently, or do not have a fresh financial plan).”

“Create an institutionalized lead generation system.

Centralized and effective lead generation is a proven competitive advantage, yet few wealth managers have mastered it. With improvements in data infrastructure and a proliferation of advanced analytics technology and talent, more wealth managers can benefit from this capability and accelerate organic growth by attracting new clients or deepening relationships with existing clients, including wealth clients in lower-value offerings (e.g., self-directed) or clients of adjacent business units (e.g., retail banking). This is especially pertinent in times of volatility, typically followed by accelerated money in motion.”

“The benefits of a robust lead generation system are many. Accelerating organic growth can make the firm more attractive to highly sought-after advisors. It also can make the client relationship with the firm stickier, lower compensation as a percentage of revenue, and create new avenues for strategic M&A. While putting in place such a system requires investment, the costs should be examined in the context of benefits they unlock. ”

Financial content has the power of connection when delivered through multiple channels consistently, especially during times of change such as economic crisis, layoffs, and life events such as divorce, death, and birth of a new family member. McKinsey’s research suggests using financial content as a communication mechanism, such as a digital newsletter or single article delivered at the appropriate time, provides the opportunity for growth and client stickiness. Additionally, using social media to position an advisor as a thought leader using third-party content or financial education on a specific topic.

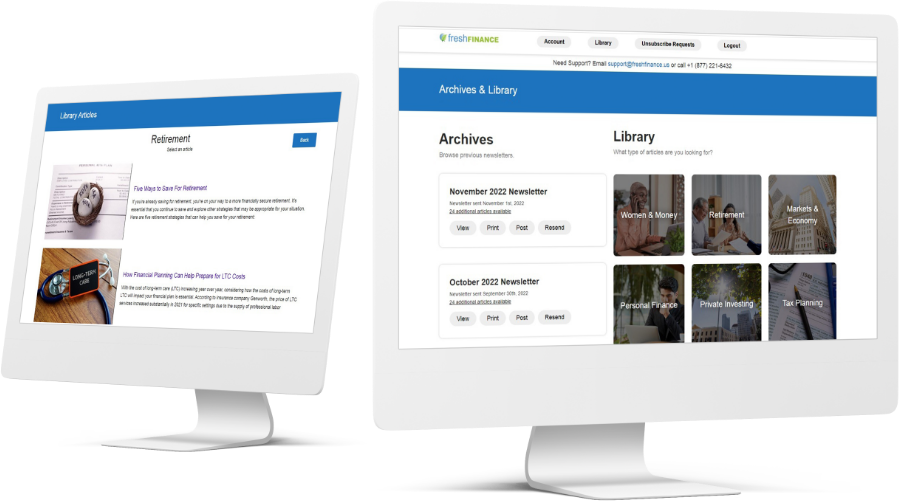

For wealth management firms with multiple advisors, an enterprise solution for financial content plus distribution tools such as Fresh Finance can help retain and attract new clients even during trying times.